No Housing Crisis in 2020! But 2021...

I wrote this article as a reaction and response to Logan Mohtashami’s piece on Housingwire.com earlier this year. He makes some interesting points on the U.S. housing market in the spring and summer of 2020. But how do his findings compare to the Dallas/Fort Worth market?

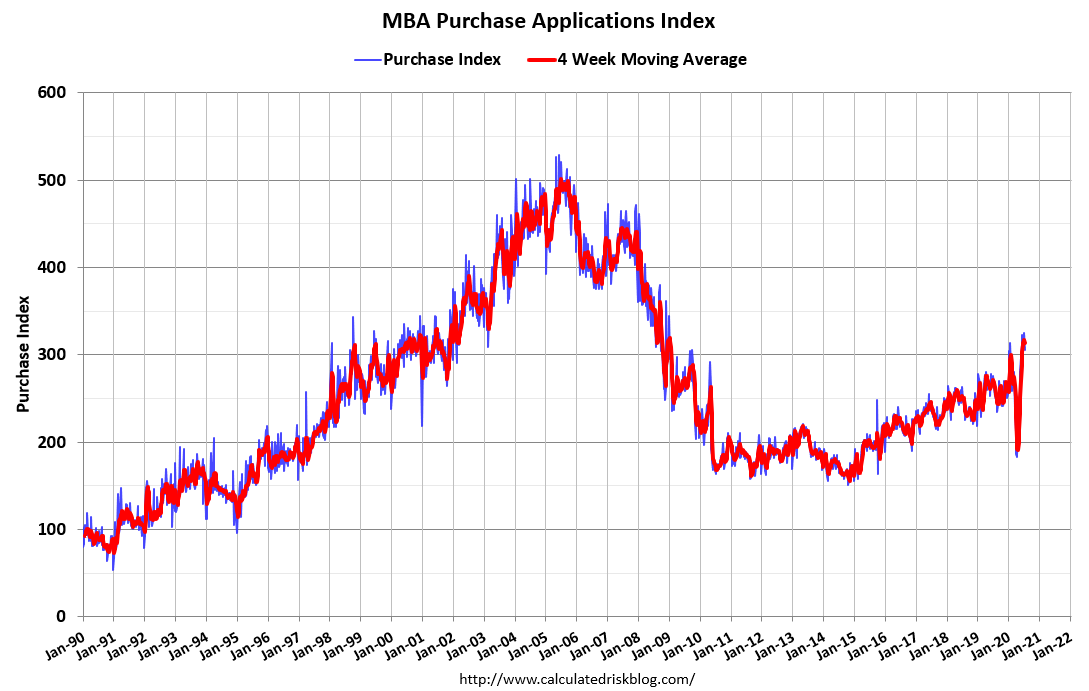

1 . Purchase Applications are Up

You may have already noticed but people are still buying houses these days. The same is true for DFW as it is for the greater country. Take a look at this chart showing purchase applications over the past 30 years. You can see how besides the huge dip in February when covid-19 first hit the states, the application rates are higher than this same time last year. Talk about a sharp-V recovery!

It isn’t mentioned in the previous graph but you can also imagine that the purchase applications are way up due to the low interest rates. Interest rates are nearly three quarters of a point lower than this same time last year. Refinances have also skyrocketed this year due to attractive interest rates and market uncertainty. They are now at a 17 year high.

2. Pending Homes Sales Are Up

The article shows nationwide pending home sales statistics and how quickly the country has recovered. However, we still have a little ways to go to meet a full recovery.

The Dallas/Fort Worth market has more than recovered when looking at pending sales. See attached graph below. We have reached an all time yearly high for pending home sales with July being the peak at over 14,000. One thing to note here…New Listings and Available Inventory are two categories that have consistently dropped since covid. I have to imagine the Pending Sales category will drop as well over time. It certainly feels like everything that hits the market these days (that is accurately priced and well marketed) is selling and selling well.

3. The Future

No one can accurately predict what will come next and I would caution you against believing the gurus of the real estate world. I don’t think many people predicted the real estate market to hold up this well against a global pandemic and yet here we are. My thoughts on this mostly stem from two realities. 1) Everyone is in need of housing. People may downgrade and downsize but that does not take away from their fundamental need for a roof over their head. 2) Covid-19 has adversely affected the world. What I mean is that blue-collar workers have taken the larger hit in the employment sector of the world. If you look at Dallas County and the job market, around 75% are white collar jobs while closer to 25% are blue collar. An inability to work remote in today’s economy is going to hurt your employability and thus your income and thus your buying power. There are people hurting here, no doubt, but it’s likely there are less people hurting in DFW than in other parts of the country and I think it is one factor as to why our real estate market has done well.

These opinions are my own and it is important you form your own too. Feel free to drop a comment below.

- Austin Wyble, Realtor & Co-Owner